From June 1 to July 30, 2025, we analyzed over 260,000 social media posts about 10 popular Greek islands, based exclusively on data from the social listening platform Brandwatch.

The analysis includes both user-generated content and posts from news media accounts, while the search was limited to English-language content, regardless of country of origin. Objective: to understand how the touristic image of Greece is reflected through the eyes of visitors and international social media use.

Περιεχόμενα

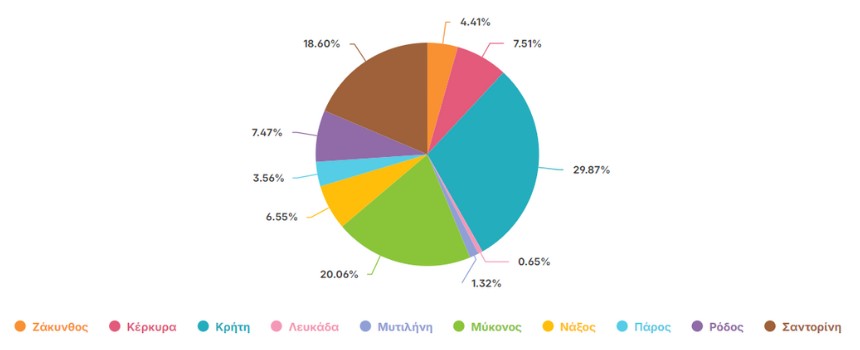

How much “space” did each island occupy in the overall social media conversation? Share of Voice (SoV) reflects which destinations dominated and their percentage share:

- Crete (29,87%): Leads the digital dialogue due to its size and the variety of experiences it offers: history, nature, gastronomy. During the period examined, its image was affected by a double crisis: wildfires that led to mass evacuations and significant damage, and a sudden increase in migrant flows straining local infrastructure. Social media conversations highlighted both the impact of the climate crisis and the social challenges facing the local community and tourism.

- Mykonos (20,06%) and Santorini (18,6%): Achieved impressive presence, boosted by luxury travel, content creators, and news coverage.

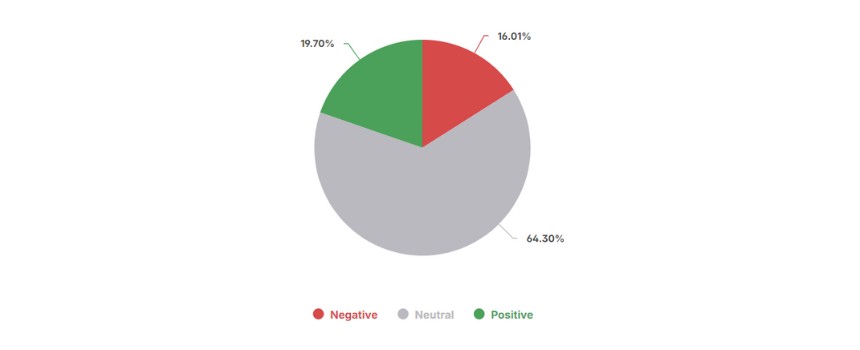

Sentiment analysis

To understand the overall impression left on the public, we analyzed the sentiment of mentions (positive, negative, neutral) for the examined period:  Overall sentiment for the 10 islands shows:

Overall sentiment for the 10 islands shows:

- 3% of mentions were neutral (usually descriptive)

- 7% were positive

- 16% were negative

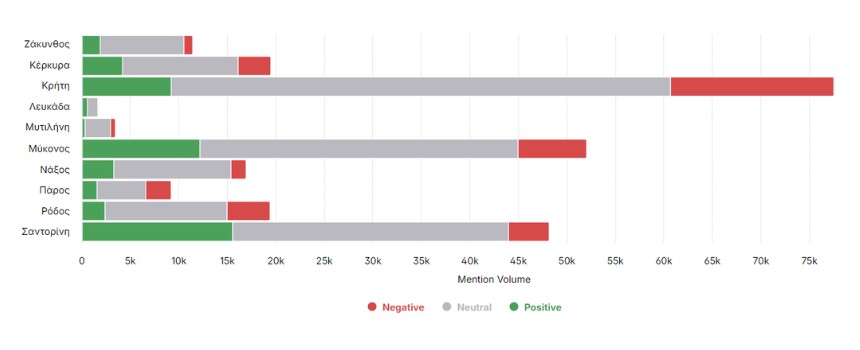

Sentiment per island

By analyzing the sentiment for each island individually, we get a more targeted view of how travelers experience each destination and where the most intense positive or negative comments are found:

Crete

Crete stood out for the diversity of tourist experiences: from beaches and archaeological sites to traditional cuisine, prompting positive comments on authenticity and local hospitality. Culinary videos featuring traditional dishes and photos from Elafonisi gained notable engagement. Negative comments focused on the early July wildfires, hotel evacuations, extreme heat, and complaints about slow public transportation.

Mykonos

Mykonos was a top subject on social media, with positive mentions about vibrant nightlife, luxury beach clubs, and celebrity sightings (e.g., visit by tennis player Novak Djokovic). Users highlighted fashion, gastronomy, and high-end hotel experiences. However, complaints surfaced about excessive prices (€25 for coffee and water on a sunbed), overcrowding, and a sense of “overtourism” that many felt altered the island’s character.

Santorini

Santorini garnered extremely positive comments for its aesthetics, with references to the Oia sunset, whitewashed villages, and romantic dinners. Popular themes included weddings, honeymoons, and organized food tours. On the flip side, some travelers complained about overtourism, transportation challenges due to the island’s steep terrain, and high prices. There were also views that described the island as “overrated.”

Rhodes

Positive comments mainly came from tourists who visited historical landmarks such as the Medieval Town and the Acropolis of Lindos, as well as those who enjoyed vegan options in new hotels. However, negative buzz increased due to protests by pro-Palestinian activists against the arrival of an Israeli cruise ship, with heavy police presence and reports of excessive force. The incidents caused reactions, with many visitors expressing surprise at the atmosphere and difficulties accessing tourist spots due to the demonstrations.

Zakynthos

Zakynthos received positive mentions for the natural beauty of Navagio Beach, organized boat tours, and the ease of exploring “hidden” beaches. Many users praised the nightlife in Laganas, although there were serious mentions of incidents involving drunk tourists and safety concerns, especially during peak student arrival periods. The balance between fun and responsibility was a recurring theme during the period.

Corfu

Positive references focused on the cultural experience and natural beauty, especially in areas like Kanoni and Pontikonisi. Users praised the photo opportunities and the “fairytale” vibe of the island. Conversely, negative comments were recorded about the airport: limited space, slow service, and overcrowding led to disappointment.

Lefkada

Lefkada received excellent comments for Porto Katsiki and Egremni beaches, as well as for sports, like windsurfing. It was praised as a value-for-money destination with an authentic vibe and alternative tourism options. However, comments noted access difficulties without a car and insufficient amenities in more remote areas of the island.

Naxos

Travelers highlighted the gastronomic aspect, local products (like Arseniko cheese), the family-friendly atmosphere, and organized beaches. On the other hand, there were some negative experiences regarding service variety in hotels and complaints about unreliable service, mainly related to bookings and transportation.

Paros

Positive comments focused on the scenic towns (Naousa, Lefkes), the calm yet stylish atmosphere, and the balance between romance and fun. Its distinction by New York’s travel magazine “Travel + Leisure” as the “Best Island in the World for 2025” drew additional positive mentions. Negative mentions related to overcrowding and parking difficulties in popular spots.

Lesvos

Users praised the authentic experience, local flavors (Plomari ouzo, seafood), and the hospitality of the locals. Strong positive posts highlighted tranquility, nature, and the island’s cultural identity. Negative aspects of the conversation included the migration issue, infrastructure problems, and the lack of organized tourism packages for more demanding visitors.

Topics cloud

The topics cloud offers a “taste” of the themes and mood of users:

- Hashtags like #greekislands, #tastegreece, #crete, #travelphotography reveal the touristic perspective.

- Emojis like ☀️🍷🏖️📸 suggest positive vibes, fun, and summer relaxation.

- Terms like “illegal migrants,” “earthquake,” “fires” indicate that conversations also include socio-political issues, especially on islands associated with such matters (Lesvos, Crete).

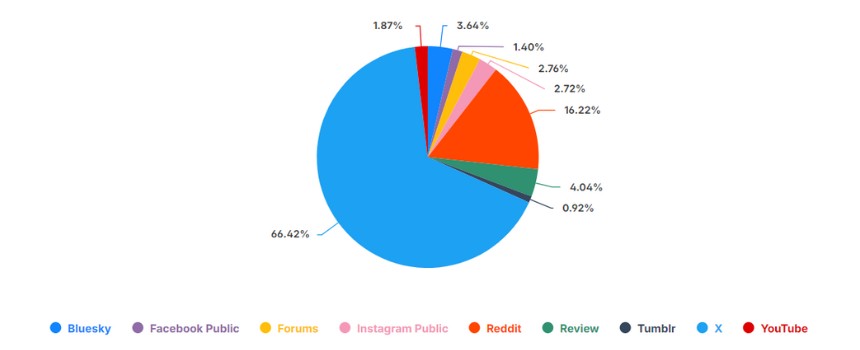

Sources breakdown

The collected mentions come exclusively from social media platforms and represent public data:

- X (Twitter): Dominant channel (66.42%) with quick, spontaneous, and often humorous responses from users.

- Reddit: At 16.22%, hosts more extensive experiences and discussions, mainly from travelers describing what they liked or disliked.

- Other platforms, such as Instagram and Facebook, contributed visuals and check-ins.

Why Social Listening Matters

Even a quick look at the June-July data revealed a wealth of useful and actionable insights for each island destination. A deep-dive analysis would certainly uncover even more: from traveler preferences and micro-trends to the factors shaping sentiment and influencing decisions to visit or return to a destination.

Businesses operating on the islands have real room to adjust their strategies for the remainder of the summer. From content marketing and influencer partnerships to handling negative experiences and improving the overall traveler experience, social listening offers a crucial competitive advantage: the ability to respond immediately and strategically in real-time, based on how visitors themselves perceive and describe the destination.

Social listening, therefore, isn’t just for major brands or international campaigns. Even without monitoring a specific brand name, the name of a destination can reveal valuable insights into how the public perceives that place. A business influenced by an island’s image and invested in branding, like a hotel, a travel agency, a transportation or food service, can leverage this data to understand traveler expectations, improve the experience it offers, or design more targeted communication efforts.

Analysis identity

Social Listening Tool: Brandwatch

Date Range: 01/06/25 – 30/07/25

Sources: Social media*

Keywording/Analysis: Clip News

*The analysis is based on publicly available data from social media channels only in the English language, with no geographic restrictions on country of origin.

Search Limitations: The Brandwatch platform collects data from websites, blogs, forums, social media (X, Facebook, Reddit, Tumblr, etc.) with the restrictions defined by each channel. For example, discussions in closed forums and Facebook private groups, or Instagram Stories, are not collected. The above analysis provides an indicative approach, taking into account that varying sources and date range may produce different insights.